Average life insurance rates are steady entering 2022

Monthly life insurance premiums were stable entering the new year, according to Policygenius data. (iStock)

The life insurance industry has kept prices stable entering 2022, according to Policygenius. Most non-smokers saw small rate increases of less than 1% between December 2021 and January 2022, while smokers didn't see any changes in their monthly premiums.

Average life insurance premiums have stayed steady despite a rise in mortality related to the coronavirus pandemic. Death benefit payouts rose 15.4% in 2020, according to the American Council of Life Insurers (ACLI). However, Policygenius data suggests that consumers don't have to worry about rising life insurance premiums at this time.

Keep reading to learn more about the average life insurance cost per month, as well as how life insurance premiums are determined. If you're considering taking out a life insurance policy, visit Credible to get free life insurance quotes.

IS PERMANENT LIFE INSURANCE A GOOD IDEA FOR YOU?

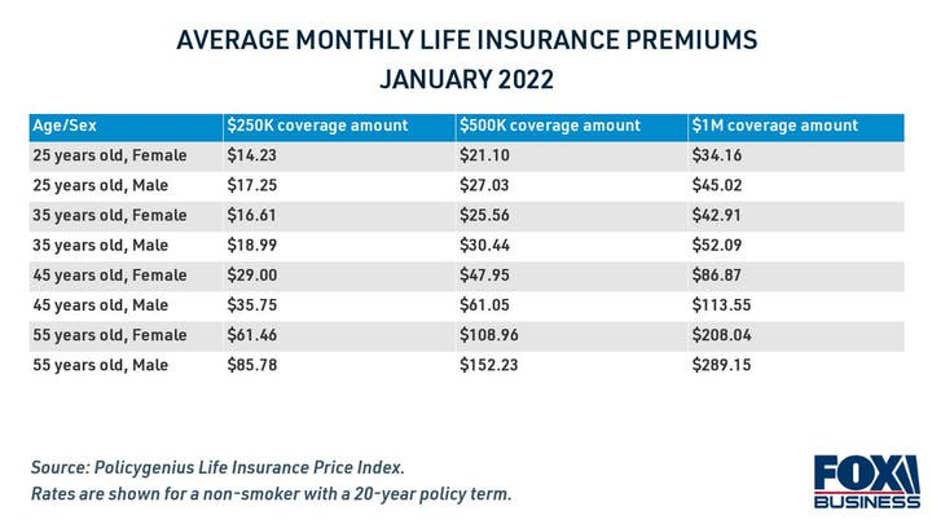

Average cost of life insurance by age and gender

Monthly life insurance premiums remained steady entering the new year, according to Policygenius data, with a minimal increase from December 2021 to January 2022.

Life insurance costs are lowest for young policyholders with low health risks, while rates tend to rise with a policyholder's age. For example, it costs $25.56 per month to insure a healthy 35-year-old woman with a 20-year term life insurance policy worth $500,000. That same policy would cost $152.23 monthly for a 55-year-old man in good health.

Average life insurance rates are also significantly higher for smokers than they are for non-smokers. The policy used in the example above would cost $224.46 per month for a 45-year-old man who smokes, compared to just $61.05 for a non-smoker of the same age.

No matter a person's age or health rating, though, life insurance rates have stayed relatively stable into 2022. If you're shopping for life insurance, you can browse policies and see monthly rates tailored to you on Credible.

LIFE INSURANCE COST BREAKDOWN BY AGE, TERM LENGTH AND POLICY SIZE

How are life insurance premiums calculated?

The monthly cost of life insurance depends on a policyholder's life expectancy. Life insurance companies take a number of factors into account, such as age, sex, health, medical history and even recreational hobbies. Consumers who are riskier to insure should expect to pay higher monthly premiums, while low-risk policyholders will cost less to insure.

To determine your health risk, life insurers may require you to undergo a medical exam. Health conditions like high blood pressure or obesity can factor into the overall cost of a life insurance policy.

Premiums are also dependent on the type of life insurance policy you have. Longer policy terms will have higher monthly costs, while shorter policy terms with lower coverage amounts will be cheaper.

It's typically recommended to purchase life insurance with a coverage amount equal to 10-15 times your annual individual income, according to Policygenius. The policy term should be long enough to cover you into retirement age.

For example, a 45-year-old mother who earns $65,000 annually may want to consider a 20-year term policy with a $1 million coverage amount. That's about 15 times her annual earnings, which may be necessary to take care of dependents if she dies unexpectedly.

On the other hand, a 35-year-old married man with no kids who earns $50,000 per year might consider a 30-year life insurance term with a coverage amount of $500,000. That policy is long enough to get him to retirement age, and the death benefit amount may be sufficient to cover expenses for his spouse.

When it comes to choosing a life insurance policy, there's no one-size-fits-all approach. You'll need to consider the best policy for your lifestyle and financial situation. Get in touch with a financial expert at Credible to determine your life insurance needs.

GETTING LIFE INSURANCE WHILE YOU'RE YOUNG AND HEALTHY CAN SAVE YOU THOUSANDS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.