SoFi CEO urges Biden to cancel $10,000 in student loan debt, restart payments

Anthony Noto is calling on the Biden administration to resume federal student loan repayment and provide $10,000 in student debt relief for distressed borrowers. (iStock)

Student loan borrowers have withstood a number of contradictory policy updates and reversals since the COVID-19 pandemic began, from federal loan servicer changes to last-minute forbearance extensions. Now, the head of a prominent private student loan company is urging President Joe Biden to take decisive action.

In a recent blog post, SoFi CEO Anthony Noto recommended that the Biden administration should "end the confusion" by canceling $10,000 worth of student loan debt for distressed and defaulted borrowers while tailoring the federal payment pause only for those in severe hardship.

- SoFi CEO Anthony Noto

Instead of issuing another sweeping forbearance extension, Noto called on the president to put capable borrowers back into repayment in May as planned. He said Biden's wavering stance on student loan repayment has cost American taxpayers over $150 billion so far, and that another broad extension could cost them $60 billion more.

Keep reading to learn more about Noto's policy suggestions, as well as how student loan borrowers can prepare for payments to resume through income-driven repayment (IDR), economic hardship deferment or student loan refinancing. You can visit Credible to compare student loan refinance rates for free without impacting your credit score.

100,000 BORROWERS NOW QUALIFY FOR STUDENT LOAN FORGIVENESS UNDER LIMITED PSLF WAIVER

Uncertainty around student loan repayment ‘drowns borrowers in confusion’

While the Biden administration issued a "final extension" of the federal student loan payment pause through January, it reversed that decision last year by extending forbearance again until May. Noto said that the most recent extension is "simply a short-term solution inflating a longer-term problem, and it drowns borrowers in confusion."

Citing recent comments from White House Chief of Staff Ron Klain that suggest another forbearance extension, Noto said the Biden administration's continued waffling "further muddies the water" for borrowers who are uncertain about when payments will resume.

He added that broadly extending the moratorium beyond May would worsen surging inflation and disproportionately benefit wealthy borrowers, instead of fixing the underlying problems of student debt.

"It’s not fair that high-income earners, especially college graduates with high six-figure salaries, get to benefit from an emergency measure that’s meant to help those in financial need, only further widening the wealth gap," Noto said.

According to Noto, 98.9% of SoFi's borrowers are making monthly payments, which "indicates that the vast majority of borrowers with income have the ability to begin repaying their loans." But despite this claim, a recent survey suggests that 93% of student loan borrowers aren't ready to restart payments in May.

If you're among the many borrowers who are unprepared for student loan repayment, you may consider student loan refinancing to reduce your monthly payments. But keep in mind that refinancing your federal student debt into a private loan would make you ineligible for IDR plans, federal deferment and select student loan forgiveness programs.

You can learn more about student loan refinancing by getting in touch with a knowledgeable loan offer at Credible.

BIDEN WANTS STUDENT DEBT CANCELLATION FROM CONGRESS, BUT DEMOCRATS URGE HIM TO USE EXECUTIVE ACTION

How to prepare for the end of student loan forbearance

Although "whispers online" suggest that the federal student loan payment pause may be extended again, Noto said, the Biden administration has not yet confirmed another extension. As such, student loan borrowers should expect for payments to resume in May as originally planned.

Here are a few ways borrowers can financially prepare for student loan repayment in just over one month.

Enroll in income-driven repayment (IDR)

IDR allows federal student loan borrowers to limit their monthly payments to 10-15% of their disposable income. After a repayment period of either 20 or 25 years, the borrower's remaining loan balance would be forgiven. The Department of Education offers four types of IDR plans:

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)

You can get in touch with your student loan servicer to sign up for IDR, and learn more about each IDR plan on the Federal Student Aid (FSA) website.

PUBLIC SERVICE LOAN FORGIVENESS JUST GOT EASIER FOR 550,000 BORROWERS

Apply for additional federal deferment

Eligible borrowers may qualify for up to 36 months of additional federal student loan deferment through the Education Department. Deferment is granted through the loan servicer when a borrower meets certain eligibility requirements, such as unemployment or economic hardship.

It's important to note that interest may accrue during this period, which means that deferring your student loans can add to the total cost of borrowing over time. Deferment is available to borrowers with federal Direct loans, Federal Family Education Loan (FFEL) Program loans and Perkins loans. The FSA website offers a guide on how to request deferment through your loan servicer.

MANY FEDERAL STUDENT LOAN BORROWERS AT RISK OF DELINQUENCY WHEN FORBEARANCE ENDS, NY FED WARNS

Refinance your student loans to a lower rate

Student loan refinancing is when you borrow a new private loan with more favorable borrowing terms to repay your current student debt. A recent Credible analysis found that borrowers who refinanced to a shorter-term student loan were able to save nearly $17,000 in interest charges over time.

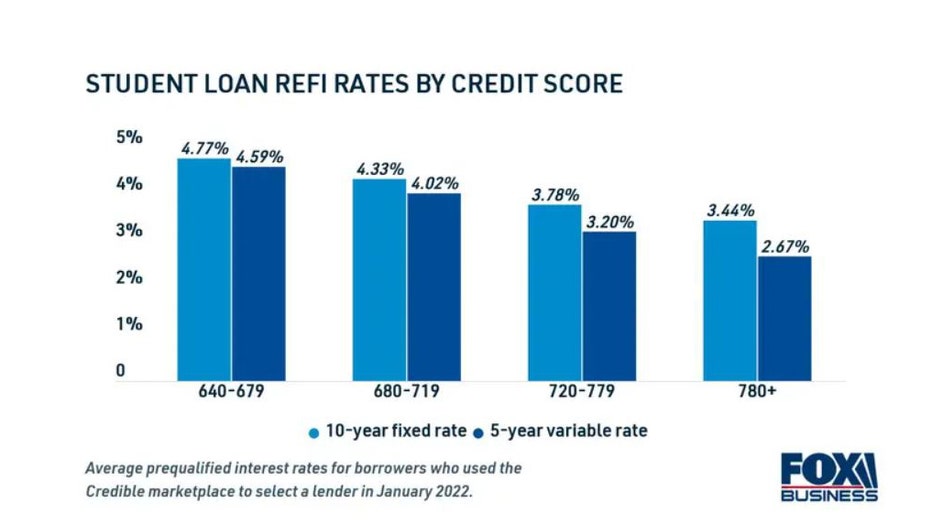

Unlike federal student loans, private lenders determine eligibility and interest rate based on an applicant's creditworthiness and debt-to-income ratio (DTI). Borrowers with good credit will qualify for the lowest interest rates available, while those with bad credit may need to enlist the help of a creditworthy cosigner like a trusted friend or relative.

Remember that refinancing your federal student loan debt into a private loan would make you ineligible for certain government protections, including IDR plans and federal deferment programs. But if you don't plan on taking advantage of these benefits, then it may be worthwhile to refinance to a lower rate.

You can browse current student loan refinance rates in the table below. Then, you can use Credible's student loan calculator to determine if refinancing is the right strategy for your financial situation.

EXPERT SAYS BIDEN HAS THE LEGAL AUTHORITY TO CANCEL STUDENT DEBT

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.