How Philadelphia homeowners can confirm property assessments

How Philadelphia homeowners can confirm property assessments

David Wilk, an Assistant Professor of Finance and the Director of Temple University's Real Estate program, joins FOX 29 to discuss the city's property assessments and how homeowners can confirm the financial figures.

PHILADELPHIA - Many homeowners are facing a tax hike and residents in North and West Philadelphia could be facing the largest increase.

Officials released the first property reassessments in three years, and they say the average residential property in Philadelphia is up 31% from the last assessment. Now, many homeowners are asking questions about how they can better understand these new assessments.

David Wilk, Assistant Professor of Finance and Director of the Real Estate Program at Temple University Fox School of Business, says that municipalities are reassessing properties to ensure that values are staying at the current market’s rate, but the most important thing for people to do is stay knowledgeable about their property.

"One of the things that most people may not realize is that you can consult with real estate professionals and ensure that they can provide you with data so that you can understand what your new assessment is just to validate whether it seems accurate or not," said Wilk.

Philadelphia property values have risen over 20% in last 2 years, city officials say

Philadelphia's Office of Property Assessment estimated that the value of Philadelphia properties have risen by 21% since the 2020 tax year. It Philadelphia's first widespread property reassessment since the coronavirus pandemic gripped the city.

Residents in North and West Philadelphia who have seen a substantial increase in their property taxes can take steps to get their property re-evaluated.

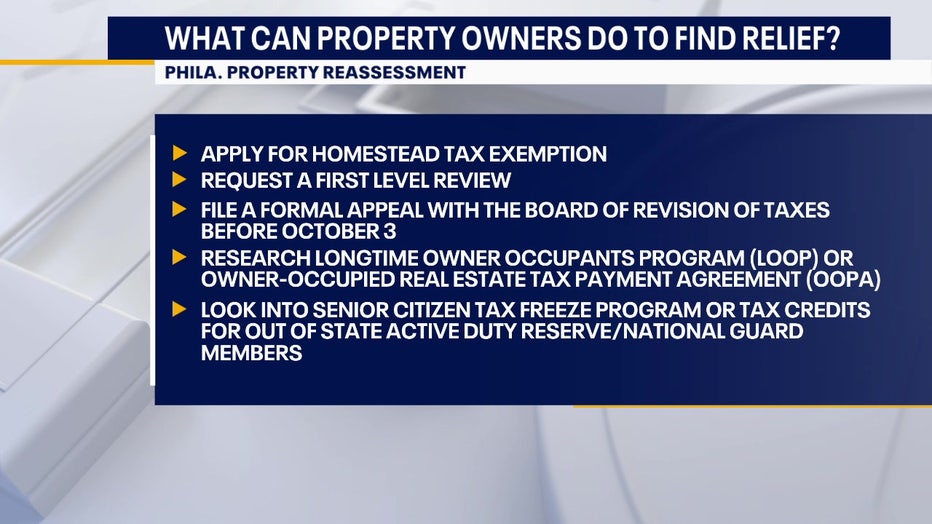

According to Wilk, property owners can apply for Homestead Tax Exemption and get a "first-level review" through a system that the city set up. This will allow residents to go and sit face-to-face with assessment officials while they review the property.

It is especially crucial for residents who may have evidence that their property is over-assessed to set up a first-level review.

"If residents are not satisfied or if they don’t any reduction from that first-level review, then they can file a formal appeal to the Board of Revision of Taxes, which is due on October 3rd," said Wilk.

Philadelphia property owners should visit property.phila.gov for more information on their property assessment.